idaho education tax credit 2021

Bishop Kelly High School 7009 Franklin Road Boise Idaho 83709. CONTRIBUTION AMOUNT 100 250 500 1000 Federal Tax Savings 25 63 125 250 Idaho State Tax Savings 7 19 37 74 Idaho Tax Credit 50 125 250 500 Total Savings for the Year 82 207 412 824 Your actual cost of the gift 18 43 88 176.

State Of Idaho Projecting Another Record Budget Surplus As Legislature Prepares To Return Idaho Capital Sun

House Bill 276 Effective January 1 2021 State and local tax workaround allowed A pass-through entity can elect to pay Idaho tax at the entity level as a workaround for the 10000 limit on the federal deduction for state and local taxes.

. Form 49 Investment Tax Credit2021 Qualifying Depreciable Property Idaho generally follows the definition of qualified property found in the Internal Revenue Code IRC sections 46 and 48 as in effect before 1986. Instruction Changes for 2021 Individual Income Tax Returns Qualifying age raised for Idaho Child Tax Credit Congress temporarily increased the age of a qualifying child from 16 and under to 17 and under for the federal definition of a qualifying child. As an Idaho tax payer your donations to the University of Idaho and the College of Engineering may be eligible for a 50 percent education tax credit which provides a reduction to the tax you owe or an increase in your refund.

Miscellaneous business income tax changes have been adopted see Conformity Page for details. Please review the chart below and consult with your tax advisor. If their tax liability was 5000 the credit reduces it to 4000.

The individual income tax rate has been reduced by 0475. Idaho Education Tax Credit. E911 - Prepaid Wireless Fee.

Current Book Review 2021 Archives. If you itemize your gift allows income tax deductions on both your state and federal returns plus a 50 Idaho income tax credit. As an Idaho tax payer learn how you may be eligible for a 50 percent education tax credit.

Fuels Taxes and Fees. For example a couple filing a joint return can claim a credit up to 1000 on a contribution of 2000 or more. So joint filers would receive the 1000 maximum credit for a 2000 gift 500 for a 1000 gift and so on.

This credit is available regardless if you itemize deductions. A tax credit is a reduction to the actual tax you owe or an increase in your refund. January 19 2021 Agenda Minutes February 16 2021 Agenda Minutes March 16 2021 Agenda.

Individual income tax rates now range from 1 to 65 and the number of tax brackets has been reduced from seven to five. You make a gift to Idaho Botanical Garden a museum. Tax Credit is the smallest of.

The state provides a tax credit worth 50 percent of the gift with a maximum tax credit of 1000 for married couples filing jointly or 500 for single filers. 1 In the case of a taxpayer other than a corporation the amount allowable as a credit under this section for any taxable year shall not exceed fifty percent 50 of such taxpayers total income tax liability imposed by section 63-3024 Idaho Code for the year or five hundred dollars 500 whichever is less. Idaho Education Tax Credit.

College of Agricultural and Life Sciences. Heres how it will work. Idaho doesnt conform to bonus depreciation for assets acquired after 2009.

The Idaho Education Tax Credit is a great way for friends of the Boise Art Museum to support BAM while maximizing the tax advantages. As we move through our third school year of COVID-19 disruption it is more important than ever to pull together in our shared commitment to. The property must have a useful life of three years or more and be property that youre allowed to depreciate or amortize.

Business income tax return changes. Electricty Kilowatt Hour Tax. Now in 2021 were facing unprecedented challenges with a long-running pandemic creating a divisive political climate.

January 26 2022 By Cascade Library Staff. 875 Perimeter Drive MS 2331. Idaho individuals may receive.

Idaho corporations may take up to 50 of a gift of 10000 a tax credit of 5000 These amounts reflect approximate rates for a joint return of 40000 taxable income and are based on the taxpayer who itemizes personal deductions. The state tax credit is up to 50 or 1000 of your donation for married couples 500 for individuals. North Star Charter School its Board and Administration do not provide any tax advice.

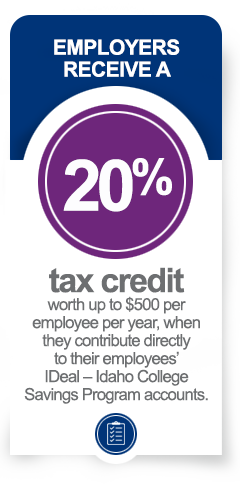

50 of your Idaho tax 10 for Corporations 500 1000 if Married filing jointly 5000 for Corporations Your Idaho tax minus the amount of credit for income tax paid to other states We encourage you to contact your tax advisor for further consultation. 2021 Meeting Dates Agendas Minutes. Idaho has a new nonrefundable Idaho child tax credit of 205 for each qualifying child.

The top rate for individuals is now 6925. Idaho conforms to the IRC as of January 1 2021. December 29 2021 By Cascade Library Staff.

Idaho State Tax Credit for 2021 Donors to the Boise Art Museum a qualifying Idaho nonprofit museum are eligible for a 50 tax credit a reduction in the actual tax you owe. If you have questions please contact the College of Law Advancement office at 208-364-4044. Tax Rate Reduction Effective January 1 2021 all tax rates have been decreased.

One-half of the amount donated 50 of your Idaho tax 10 for Corporations 500 1000 if Married filing jointly 5000 for Corporations Your Idaho tax minus the amount of credit for income tax paid to other states. The annual election and related tax payment must be made by April 15 of the following year.

Idaho State Senator Floats Plan That Would Eliminate School Supplemental Levies Idaho Capital Sun

Tax Day Is Coming Soon Here S What You Need To Know About Filing Your 2021 Taxes East Idaho News

The Numbers Who Gets Rebates Tax Cuts Under House Bill Local News Idahopress Com

How Do K 12 Education Tax Credits And Deductions Work Edchoice

How Much Is Your Rebate New Idaho Law Will Give 600 Million In Income Tax Cuts East Idaho News

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Idaho Begins New Fiscal Year Eyeing Record 800 Million Plus Budget Surplus Idaho Capital Sun

Idaho Education Tax Credit Idaho Botanical Garden

Idaho Receiving 5 6 Billion Through Arpa Now The Hard Work Begins Idaho Reports

Idaho Residents To See Tax Relief Money As Soon As Next Week East Idaho News

Sitting It Out Idaho S College Go On Rate Falls Once Again